Earlier this week, the AP

unearthed a document comparing the cost to

taxpayeres of Gov. Pat Quinn's pension "reform" proposal as opposed to the

current pension system. In selling his

"two-tiered" plan, Quinn and others have

emphasized that scaling back benefits for future state workers and keeping

people on the payroll longer will shrink Illinois' pension liability by $150

billion as of 2045. On its face, this sounds like it would save

taxpayers money during the alotted timeframe. But the projections

highlighted by the AP -- and

obtained by Progress Illinois -- show that

Quinn's plan would actually cost taxpayers $95 billion more over the next

36 years.

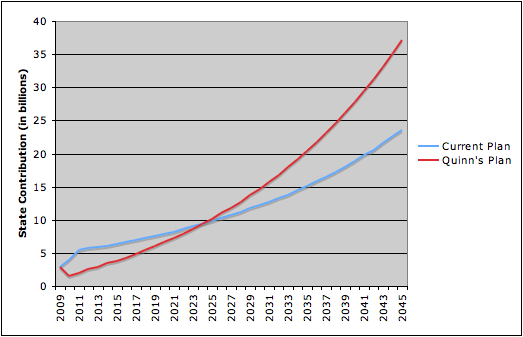

How can this be? The AP didn't really explain that part, so we'll try to do a

better job here.

It's important to remember that Quinn is using the "two-tiered" system to

justify skimming another $2.8 billion from the pension fund this year (in order

to balance the budget) and deferring half of the required $24 billion in

payments through 2013 (the habit that helped create this budget mess in the

first place). As the graph below shows, the contributions under Quinn's

plan track well below the current schedule over the next decade or so. In

2025 both systems level out, contributing about $10 billion each. Then, over the

next 20 years, Quinn's plan requires much larger infusions:

As you can see, while Quinn's system saves taxpayers $28.4 billion between 2009

and 2025, it costs them $123.1 billion more between 2026 and 2045:

Why the steep increase in state contributions? It goes back to Investing

101. Because the Quinn system scales back its contributions to the fund in

the early going, its investments are smaller and mature at a slower rate.

For instance, look at the projections as of 2025. The

current system has $125 billion worth of assets and is 51 percent funded at this

juncture. By contrast, Quinn's plan has only $52 billion worth of assets and is

22 percent funded. In order to meet the goal of a 90 percent funded ratio

by 2045, Quinn's system then requires much larger contributions to make up for

lost time. (Imagine balancing the budget in those years ...)

Based on these calculations, it's easy to see why the public employee unions are

up in arms about the rush to cut back future employee benefits. If this

fast-tracked proposal ultimately passes, we'll

hear a lot about fiscal responsibility and reining in the "gold-plated" pensions

purportedly enjoyed by retired state workers.

But while this may go over well with voters in the short term, the reality is

that taxpayers are going to end up paying more for less down the road.