-

Why should I care?

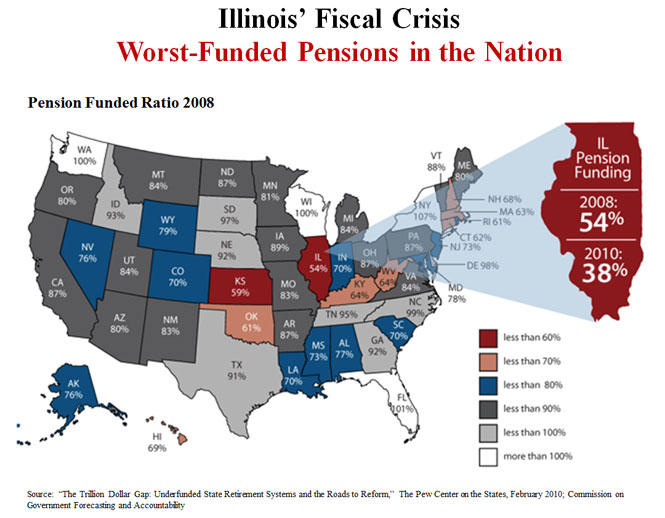

Illinois is in a full-blown fiscal crisis, and at its core is the $85 BILLION unfunded liability of the state’s five pension plans. According to the Pew Center on the States, Illinois has the worst-funded state pensions in the nation. At the end of FY2010, the five state plans were only 38% funded.

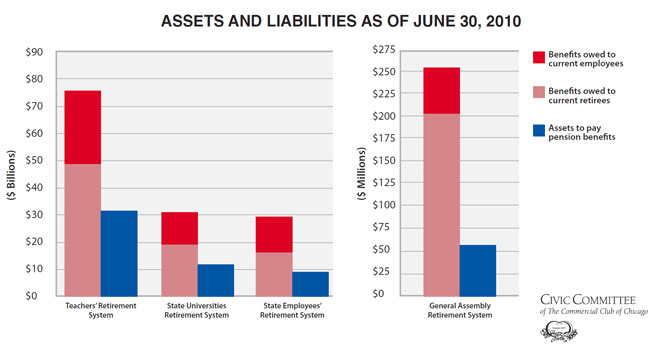

The pension funds today do not even have sufficient assets to pay for the benefits of current

retirees, let alone those for current employees who are contributing to the funds each and every paycheck. If the funds run out of money, it would be a tragedy for everyone in the state.

-

How will this affect me?

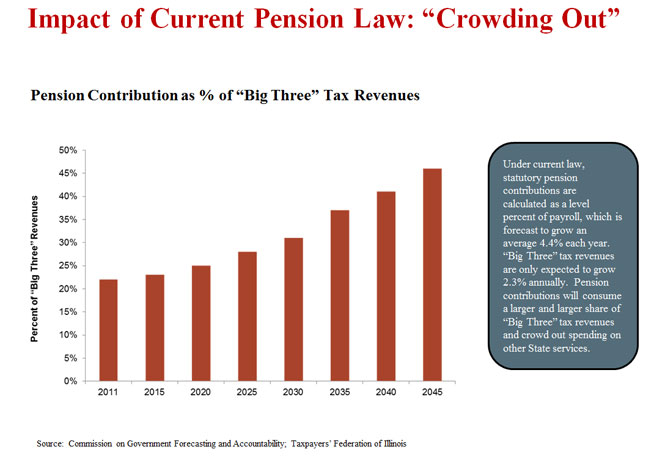

Under current law the state is expected to make pension contributions each year that grow at about double the rate of expected growth in “Big Three” taxes (personal and corporate income taxes and sales taxes). Over time, pension contributions will take up more and more of these tax revenues – leaving less and less for essential state services such as education, public safety and health care for the poor.

Without pension restructuring, almost 50 cents of every dollar of Big Three taxes will have to go to pension contributions by 2045.

-

How did this happen?

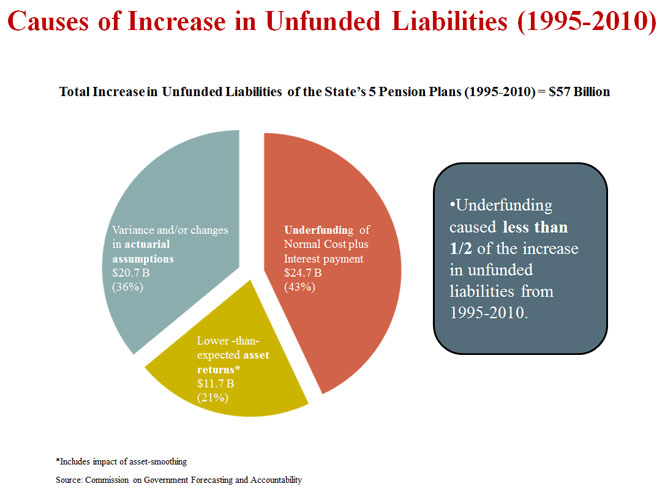

We have all heard reports that inadequate contributions from the state are the main culprit behind the current unfunded pension liability. According to analysis by the state agency that monitors the pension plans, this is only partially true.

The state’s historical underfunding of the plans accounted for 43% of the growth in the unfunded liability over the last 15 years, while lower-than-expected asset returns accounted for another 21%. However, variances or changes in “actuarial provisions and assumptions” accounted for the remaining 36% of the growth in the unfunded liability. “Actuarial provisions and assumptions” include longer life expectancies, benefit enhancements and other factors which made the plans more expensive than originally anticipated.

-

Why weren’t the recently-enacted reforms for new hires sufficient? Is restructuring the pensions of current employees constitutional?

The recently-enacted reforms for new employees were a good first step but they did not go far enough. Because the reforms apply only to new hires, the state will not see any savings for years. The unfunded pension liability will continue to grow for two decades, and pension contributions will crowd out essential state services.

Lawmakers must restructure pension benefits for current employees going forward, while preserving the benefits that current employees and retirees have already earned.

CLICK HERE TO READ THE SIDLEY AUSTIN ANALYSIS SHOWING THAT RESTRUCTURING THE PENSION PLANS FOR CURRENT EMPLOYEES IS CONSTITUTIONAL (PDF)

-

Are you trying to take away the pensions of public servants?

Absolutely not! The intent of pension restructuring is to save the pension plans, not to take away benefits. Current

retirees will see no change in their benefits as a result of pension restructuring, and the benefits that current

employees have already earned will be preserved. Senate Bill 512 makes these benefits more secure by putting in place a conservative funding schedule to pay down the current unfunded liability. Compare this to the current situation, where the pension funds will be allowed to remain at dangerously low funding levels for almost two decades – putting them at risk in the event of a double-dip recession or another market downturn in the next 20 years. If the funds run out of money, Illinois’ public employees will have a claim against the insolvent pension funds, but not the state – which would be a disaster for them and their families.

CLICK HERE TO READ THE SIDLEY AUSTIN ANALYSIS SHOWING THAT THE STATE IS NOT THE GUARANTOR OF THE PENSION FUNDS (PDF)